DLT News feed - Distributed Ledger Technology Articles

Keep up-to-date with the latest DLT news feed online and enjoy daily additions of the most popular related articles!

25Jul 24

Qatar News Agency on X: “#Qatar_Central_Bank Issues Distributed Ledger Technology (DLT …

Qatar_Central_Bank Issues Distributed Ledger Technology (DLT) Guideline #QNA #Qatar #Economy https://t.co/XybAloPe8H.

25Jul 24

Qatar Central Bank Issues Distributed Ledger Technology (DLT) Guideline – QNA

Qatar Central Bank Issues Distributed Ledger Technology (DLT) Guideline 25 July 202409:56 AM Article Number :0011 Doha, July 25 (QNA) - In line with the Third Financial Sector Strategy, the FinTech Strategy, and Qatar Central Banks endeavor to regulate and develop the financial sector and enhance the FinTech ecosystem in the country, Qatar Central Bank

24Jul 24

Papua New Guinea joins CBDC race, taps Soramitsu to lead development efforts

Papua New Guinea is the latest nation to throw its hat in the ring for a central bank digital currency (CBDC), with the Pacific island nation seeking use cases around financial inclusion for its citizens. This CBDC effort is an experimental project designed to assess the offering’s viability before a full-scale commercial rollout. The Bank

24Jul 24

The Impact of FinTech on the Future of Cross-Border Investments and Capital Markets

The rapid evolution of financial technology, commonly known as FinTech, has significantly reshaped various aspects of the financial sector. One of the most profound areas of influence is on cross-border investments and capital markets. As technology continues to advance, it brings about transformative changes that enhance efficiency, reduce costs, and improve accessibility for investors worldwide.

24Jul 24

Scaling infrastructure for digital securities settlement – Börsen-Zeitung

Scaling infrastructure for digital securities settlement In May the European Central Bank tested the settlement of securities using distributed ledger technology (DLT), and a second wave of tests was recently launched. „The response to this second round of testing is huge. Around 60 market participants have registered. This shows that banks and clearing houses want

24Jul 24

Globacap CEO Slams AIM: No Longer Fit For Purpose | Crowdfund Insider

Please enable cookies. Sorry, you have been blocked You are unable to access crowdfundinsider.com Why have I been blocked? This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word

24Jul 24

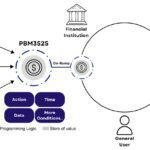

Ample FinTech Announces PBM3525, a Transformative Programmable Payments … – Morningstar

SINGAPORE / ACCESSWIRE / July 23, 2024 / Ample FinTech, a Singapore-based FinTech company, revealed its novel programmable money technology PBM3525 today. This technology enables individuals and commercial users to configure and customize payment conditions and logics on blockchains without involving financial intermediaries or programming smart contracts themselves. Ample FinTech stated that it has successfully

23Jul 24

Cboe Clear Europe & ABN Amro Test CBDC as Collateral | FTF News

The duo took part in an experiment on the use of DLT for non-TARGET margin calls. Cboe Clear Europe, a pan-European clearinghouse, and ABN Amro Clearing Bank N.V., report that they have been testing the use of a central bank digital currency (CBDC) as collateral, essentially exploring the potential of distributed ledger technology (DLT). In

23Jul 24

Nomura backed Libre expands fund tokenization to Solana with Hamilton Lane

Today Libre unveiled its tokenized funds on its second public blockchain, Solana. The new fund is a feeder fund for Hamilton Lane’s Senior Credit Opportunities Fund (“SCOPE”). Libre is a public blockchain fund tokenization protocol, which is a joint venture between Nomura’s digital asset arm Laser Digital and WebN, founded by the former CEO of Brevan

23Jul 24

CJC And DLT-powered DRDM Raises Bar For Market Data Management – Mondaq

PRESS RELEASE 23 July 2024 CJ CJC Ltd More CJC is the leading market data technology consultancy and service provider for global financial markets. CJC provides multi-award-winning consultancy, managed services, cloud solutions, alert monitoring and observability, and commercial management services for mission-critical market data systems. CJC is vendor-neutral and ISO 27001 certified. The DRDM DLT

AI and analytics driving digital customer loyalty

1 March 2022

The explosion of online retail and multitude of new brands entering the market is offering customers more choices…

Predictions for emerging technologies in the new year

6 February 2022

The new year is here and promises to usher in new opportunities for the development of artificial intelligence…

Reflecting on the impact of emerging technologies in 2021

10 January 2022

Throughout the past year, we've explored quite the variety of blockchain use cases via our ‘SDLT x SAPIO…

[email-subscribers-form id=”1″]