Hype to institutional reality: tokenisation transforms fund industry

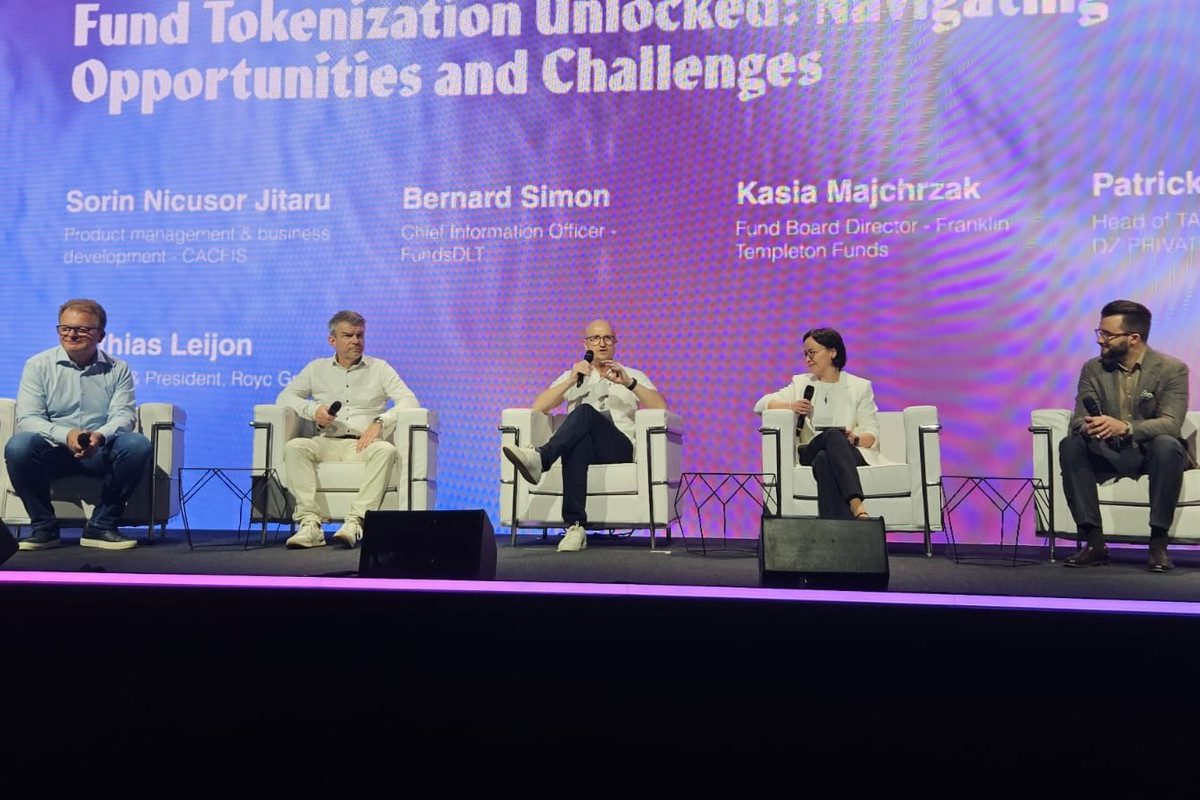

Fund tokenisation is no longer a speculative “marketing hype” but an inevitable shift, said a panel of industry leaders speaking at the Nexus 2025 technology conference on 18 June 2025. Moderated by Mathias Leijon, founder and president of Royc Group, the discussion concluded that digital processes and blockchain integration are becoming indispensable across the asset management sector.

Fund tokenisation refers to the process of converting ownership rights in investment funds into digital tokens via blockchain. Each token represents a share in the fund, enabling easier, faster and more transparent trading and settlement. The panellists noted that the integration of such technologies is evolving from experimentation to institutional application.

First movers

Kasia Majchrzak, fund board director at Franklin Templeton Funds, stated that the firm was among the pioneers in blockchain adoption, having launched blockchain-available funds as early as 2021 in the United States. She remarked on the unexpected speed of progress and attributed Franklin Templeton’s early involvement to its ability to explore hybrid models, native issuances and other innovations.

Majchrzak identified Luxembourg as a strategic hub for European expansion, citing granted by the Luxembourg Financial Sector Supervisory Commission (CSSF) in 2024. However, she also highlighted the challenges faced, particularly in developing internal technology and skillsets. “It is a continuous process,” she said, noting that many development initiatives are advancing in parallel at “extraordinary pace”.

Value chains

Bernard Simon, chief information officer at FundsDLT, supported Majchrzak’s assessment and emphasised blockchain’s capacity to reshape value chains. Digitalisation is changing the entire value chain–not only ledgers and registers but trading as well, he emphasised. On-chain transactions, Simon argued, are not only more transparent but also quicker and easier to execute.

He added that onboarding processes have become significantly faster and that the industry is preparing for the integration of digital wallets, digital currencies and stablecoins at a rapid pace. According to Simon, the availability of money market funds (MMFs) on blockchain platforms has made liquidity management both cheaper and more efficient. He further questioned the continuing relevance of traditional custody services, pointing out that increased on-chain activity has rendered transactions more accessible, transparent and self-custodied.

Simon also noted that distributed ledger technology (DLT) and fund tokenisation were reducing transaction costs by up to 50% in some cases, benefiting both institutional and retail investors.

Hybrid funds distribution

Patrick Hennes, head of transfer agency development and DLT at DZ Privatbank, underscored the emerging duality in fund operations. He explained that both traditional registries and DLT-based systems are now operating in parallel to serve diverse client needs. According to Hennes, fund tokenisation has moved beyond marketing narratives and achieved “institutional grading,” with fintech companies now rivalling traditional institutions in their technological offerings.

Costs and market penetration

Sorin Nicusor Jitaru, of product management and business development at Caceis, agreed with the other panellists regarding the pace of market adoption. He noted, however, that while digitalisation is progressing, the most significant cost efficiencies are yet to be realised. Jitaru forecasted further synchronisation across fund lifecycle stages–from creation to delivery in a digital wallet, for example–which could lead to lower client fees and greater market penetration. He argued that such efficiencies could help unlock further market share in the $68trn global funds industry.

Majchrzak added that the development costs for digital products and technologies are to be considered as well, though she maintained that the long-term cost benefits were likely to outweigh initial investments. She too believed that further optimisation in fee structures would follow.

Future outlook

The panel agreed that increasing regulatory clarity and standards are reinforcing trust in digital fund products. Jitaru concluded that blockchain and DLT would enable tokenised funds to achieve, within the next five to ten years, what took traditional markets nearly 50 years to accomplish. He predicted a future marked by faster, cheaper and more resilient fund operations, supported by significantly reduced operational risks.

The panel expressed not only optimism but a clear strategic consensus: fund tokenisation has moved beyond the fringes of finance and is set to grow at a significantly faster pace, assuming a far more central role in global financial markets than ever before.