ADX goes high-tech! UAE launches MENA’s first blockchain-powered digital bonds – Regtechtimes

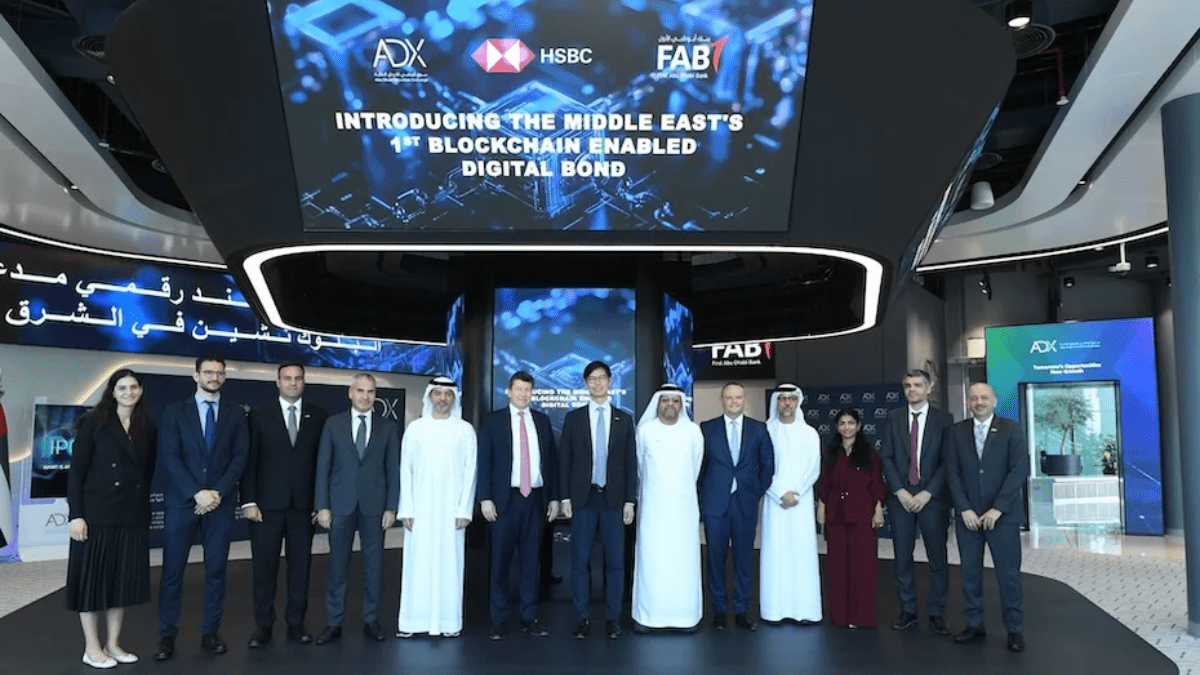

The Abu Dhabi Securities Exchange (ADX), in partnership with First Abu Dhabi Bank (FAB) and HSBC, has launched the pricing stage of the Middle East and North Africa (MENA) region’s first-ever digital bond powered by blockchain technology. This new type of bond is not printed on paper or held in traditional systems—it is completely digital and runs on a secure and advanced system called distributed ledger technology (DLT).

This digital bond is also known as a DLT-based digital bond and is now listed on ADX. It is available on HSBC Orion, a digital asset platform managed by the Central Moneymarkets Unit (CMU) in Hong Kong. The launch of this bond shows how financial systems in the region are evolving with the help of modern technology.

The collaboration between ADX, FAB, and HSBC shows how three major players are working together to modernize how investments work in the UAE and the wider region. With this move, Abu Dhabi strengthens its role as a hub for high-tech financial products.

Won in Danger? Korea Lifts Kimchi Bond Ban After 14 Years of Silence

How It Works and Why It Matters

This digital bond uses blockchain technology. Blockchain is a special kind of digital record that is secure, fast, and almost impossible to change once something is added to it. By using blockchain, the bond offers many benefits that traditional bonds do not.

One of the biggest advantages is faster settlement. In simple terms, when someone buys or sells this bond, the process takes less time than usual. It also lowers the risk of one party not keeping their side of the deal—something known as counterparty risk.

In addition, the bond is designed to be more secure and transparent. That means every transaction is recorded clearly and safely, and everyone involved can trust the system. This is especially helpful for big investors who deal with large sums of money and want more confidence in their investments.

Another important feature is how the bond fits smoothly with global financial systems. Investors from around the world can access this digital bond through well-known platforms like Euroclear, Clearstream, or CMU. They can do this either directly through HSBC Orion or by using the same custodian banks they already trust.

Bond Panic Triggers Historic Pivot—Japan Pulls Back as Super-Long Yields Hit Record Highs

A Landmark Moment for Regional Markets

This launch represents a first-of-its-kind move in the region and is seen as a major achievement for ADX, FAB, and HSBC. Each organization played a special role in making the bond a reality. ADX helped integrate the digital bond with existing systems. FAB acted as the issuer of the bond. HSBC supported the process by acting as the global coordinator, lead manager, and bookrunner.

By successfully issuing the region’s first blockchain-powered bond, the three organizations have shown that advanced technology can work well with trusted financial institutions. It also opens the door for other types of digital investments in the future, like green bonds, real estate-based products, and more.

For now, this bond offers global investors a safe and efficient way to invest using the latest technology. The launch sets a new standard in the region for how bonds can be issued, traded, and managed in a digital format.