JPM Coin Institutional Launch by JPMorgan

JPM Coin Institutional Launch Expands Access to Digital Payments

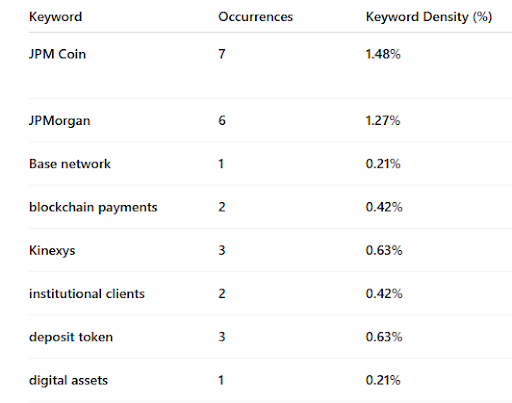

JPMorgan has officially completed the JPM Coin Institutional Launch on Coinbase’s Base Layer 2 network, offering enterprise clients a faster and regulated method of digital ledger payments. The token is a symbol of U.S dollar deposits at the bank and allows transactions to be completed in a few seconds. JPM Coin Institutional Launch is the solution that allows to make payments 24/7, eliminating the time constraints of conventional systems.

Source: X

This rollout follows successful pilot tests with Mastercard, Coinbase, and B2C2. According to Bloomberg, JPM Coin Institutional Launch is part of JPMorgan’s broader DLT strategy to simplify settlements for corporate transactions. The project is a step towards the incorporation of distributed ledger into the traditional financial infrastructure, which will be fast, transparent, and compliant.

Naveen Mallela, global co-head of JPMorgan’s blockchain division Kinexys, confirmed that the firm will expand access to clients’ customers and develop additional versions in other currencies, pending regulatory approval. He added that the bank aims to link the token to more digital ledger, having already secured the trademark JPME for a euro-based variant.

Deposit Tokens Offer Regulated Yield Potential

The new deposit token differs from typical stablecoins. JPM Coin Institutional Launch is fully backed by deposits held at JPMorgan, providing both security and regulatory oversight. Unlike stablecoins, it has yield-bearing potential, allowing enterprise clients to earn returns on the underlying balances.

Mallela said that deposit-based tokens offer professional clients an attractive alternative to stablecoins, combining the reliability of bank deposits with digital ledger’s efficiency. This hybrid model enables the funds to transfer safely and quickly across networks without threat of breach due to stringent compliance protocols including KYC and AML.

The Kinetys Digital Payments network of JPMorgan already handles more than $3 billion in daily blockchain transactions in USD, EUR and GBP. With the JPM Coin Institutional Launch, that is extended to public distributed ledgers, and a trusted banking framework allows onchain payments to be made.

Banks Accelerate Adoption of Blockchain Payments

The JPM Coin Institutional Launch signifies an increased trend in the adoption of tokenized deposit systems among international banks. The other card payment models being developed by Citigroup, Deutsche Bank, and PayPal are distributed ledger-based models to simplify payments. Barclays, Lloyds and HSBC are experimenting with tokenized sterling deposits in the United Kingdom to improve their efficiency in payments.

Recently, DBS and Kinexys collaborated to develop an interoperability system to transfer tokenized deposits between public and permissioned distributed ledgers. Meanwhile BNY Mellon is evaluating DLT-based deposit systems in order to bring its payment system into the modern world. The move by JPMorgan to venture into this field strengthens the idea of the firm being among the busiest financial institutions when it comes to digital asset adoption.

JPM Coin Institutional Launch is the attempt of JPMorgan to combine digital innovation and traditional banking. The project is an indication of a transition to controlled blockchain payments aimed at corporate clients who want prompt, regulated, and profitable payment solutions.