Calastone projects $135 billion tokenization savings for asset managers – Ledger Insights – blockchain for enterprise

Calastone, the funds network owned by Carlyle, surveyed 26 asset managers to get feedback about their costs and fund tokenization. Based on the responses, It projects a potential savings of $135 billion per year from tokenization.

“Tokenisation is already becoming a core pillar of strategy for asset managers, offering a path to greater efficiency, flexibility, and competitiveness,” said Brian Godins, Chief Commercial Officer at Calastone.

“While adoption will be incremental, the direction of travel is clear – tokenisation represents the next stage in the evolution of investment vehicles, building on the legacy of mutual funds and ETFs. As firms explore its benefits, we expect to see a gradual integration alongside existing structures, enabling asset managers to modernise at their own pace.”

Calastone is also promoting Calastone Digital Investments, its service to ease the path of asset managers with tokenization. Meanwhile, earlier in the year, Reuters reported that Carlyle might be looking to sell Calastone.

The report contains a lot of interesting detail, such as potential savings of 23% on current costs, and predicted growth in costs of 32% over the next three years. Combining these two factors, they project a 30% savings at current costs.

For new funds, tokenization is expected to cut the launch time by three to four weeks and reduce the average seed funding of $50.3 million by almost a quarter.

Analyzing the $135 billion savings

We like to analyze these sorts of forecasts, but struggled to find the details needed. Follow up questions helped for the global figure, but less for the breakdown of the 23% savings.

This is how we believe Calastone arrived at the $135 billion figure:

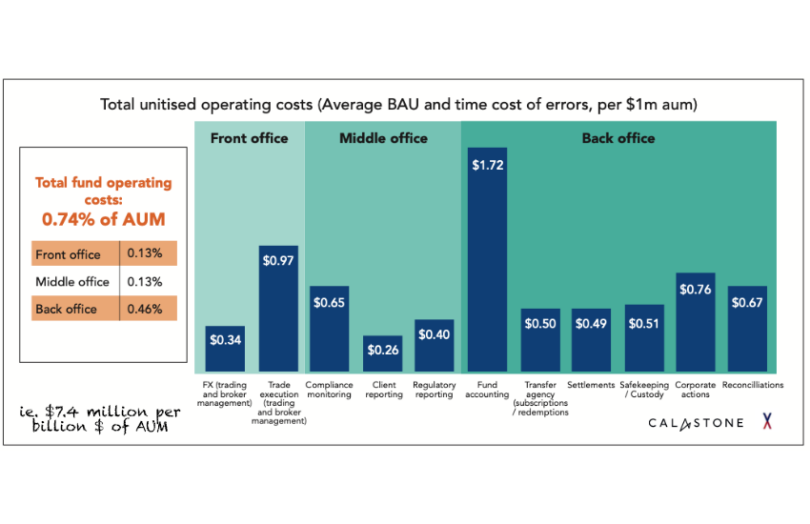

- Current costs per billion of assets under management (AUM): $7.4 million

- Expected savings of 23%

- But given costs are expected to grow at 32% over three years, the savings are equivalent to 30% of today’s costs (23% x 1.32)

- 30% of $7.4 million costs is $2.22 million savings per billion AUM

- With $61 trillion in AUM that equates to $135 billion (61,000 x $2.22m) savings.

Based on other findings in the report, these may be conservative figures. Firstly, for global AUM only US mutual funds, EU UCITS and UK AUM were counted. So Asia, Canada, Latin America and Africa are left out.

One of the report findings related to the impact of tokenization on revenues. Larger funds expect a 10% drop in costs to boost assets under management from wealth and retail investors by 10%. Overall, this was projected to increase revenues by $1.4m – $4.2m for an average fund. It was unclear whether Calastone included a rise in projected revenue in the $135 billion figure, but we think not.

There is one caveat. These figures assume that every dollar of funds is tokenized, so it will take a while to fully reap the benefits. Both McKinsey and BCG forecast around $0.4 trillion in funds will be tokenized by 2030, which would translate to a not-too-shabby $880 million saving.

This report is not the first to explore the potential benefits of tokenization to asset managers. Last year Bain and JP Morgan looked into the possibilities for the alternative assets sector, finding a $400 billion revenue potential.